Selling The Carry

Selling the Carry to Capture Extra Premiums in Your Farm Marketing, With or Without Farm Storage.

When there are multiple years in a row of good crops nationally and we continue to build carryout, we often see two main fundamental consequences: lower prices and more carry in the futures market. Of course, lower prices are not a great ingredient to add to your farm profitability formula. However, the carries in the market do offer a glimpse of hope if treated properly.

What does “carry in the market” mean?

Carry market is defined by deferred futures months prices being progressively higher the farther into the future it gets from the nearby month. For instance, a market where futures quotes look like this:

May 2019 Corn $3.50

July 2019 Corn $3.60

September 2019 Corn $3.70

December 2019 Corn $3.80

This is the type of market structure we have seen in grain for quite a few years in a row now. The key question is: How can you utilize this market structure to get a higher price for your grain?

This may seem counterintuitive, but the only way to capture the full value of these carry markets is to make your selling decisions sooner. Many producers look at a carry market like this and assume it gives them more time to wait to sell because, after all, the prices are higher the farther out you go. This line of thinking is a recipe for disaster and has led to some extreme disappointment over the last several years among grain producers.

Here is a very good example: Hypothetically, it’s fall and harvest is winding down. The local elevator spot bid for corn is $3.47, but their January bid is $3.70. Farmer Cletus decides since January bid is better, he will wait until then. When January rolls around, the elevator’s bid is now… $3.47… again. That 23 cents of “carry in the market” vanished. The farmer didn’t get it and neither did the elevator. This has been a common scenario played out over and over again for a few years running at locations all across the country. In order to capture all of the premium offered by the carry in the market, you must sell early for the deferred delivery periods while there is still carry to be captured. Otherwise, many times the carry vanishes over time.

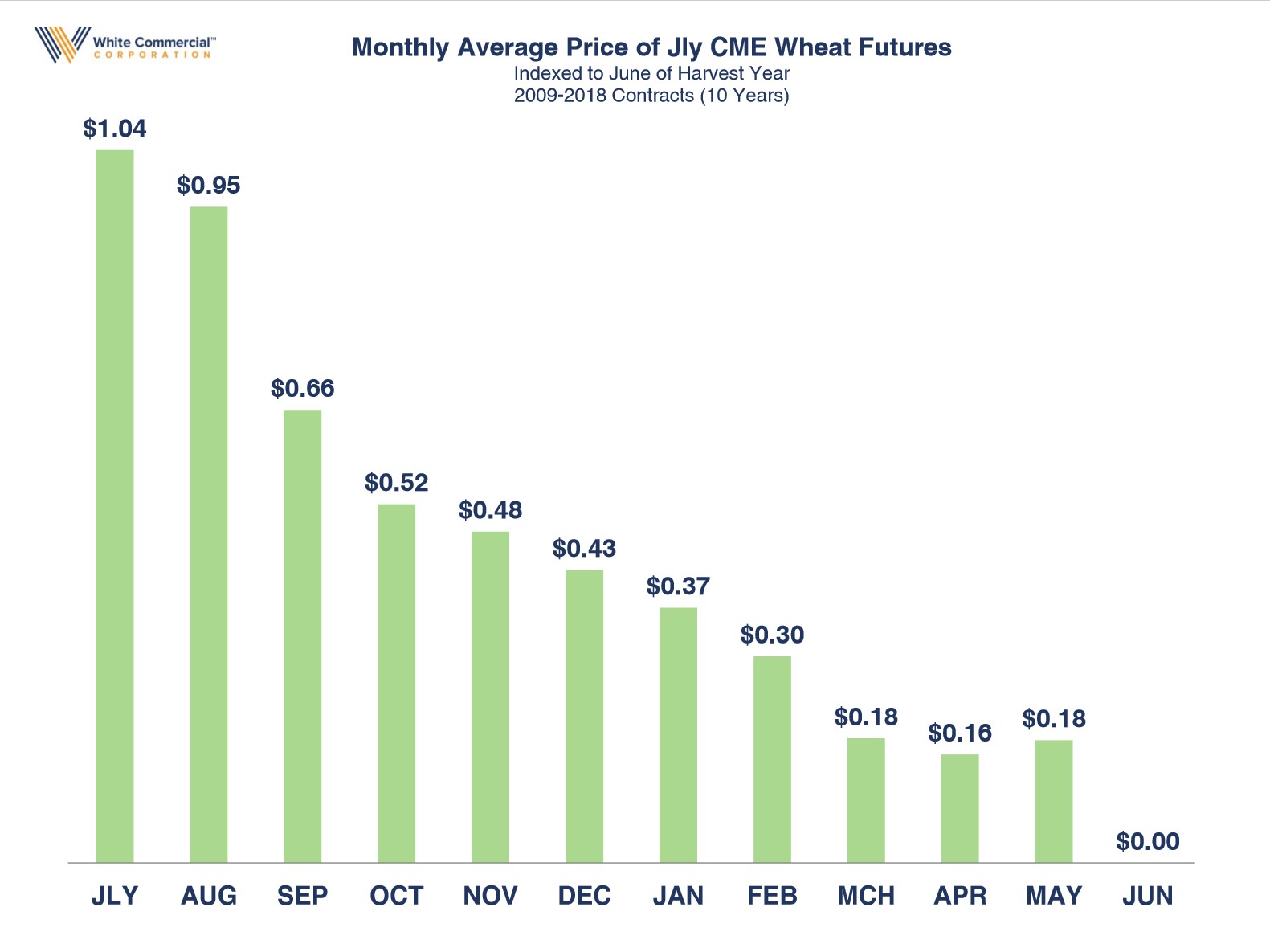

When you forward contract, you are capturing the carry in the market. A great example of this has been wheat over the last several years. Here is a chart showing how much of a price premium above harvest price was captured over the last 10 years on average:

That’s right, over the last 10 years, on average, a farmer could have sold more than $1.00 per bushel better by selling 1 full calendar year prior to harvest. Other grains have similar patterns. Wheat is so exaggerated because there has been such great carry in their markets. The farther ahead of harvest you can sell in a carry environment, the more you can capture. This doesn’t even require you to have your own bins. You can sell the carry well ahead of harvest for harvest delivery and capture all of that.

For those with farm bins, this applies as well, but to an even greater degree. You can sell even farther out into the future and capture not only more carry, but the post-harvest basis improvement as well. Using your farm bins as a reason to wait longer to make selling decisions isn’t a prudent way to achieve returns on your space. The way to achieve returns to grain space is through capturing carry and basis improvements.

While large supplies and low prices don’t always make for a fun farm marketing year, those who know how to harness the power of the carry in the market can still find a way to sell prices that work.

How far ahead can you sell? Plan ahead and get in offers with one of Superior Ag’s Grain Merchandisers ASAP!

Huntingburg/Ireland 812-683-2809 ext. 1122

Princeton/Francisco 812-385-3487

Content Source: White Commercial Corporation